Noca Scotia’s 2024 Budget Highlights

On February 29, 2024, Nova Scotia’s Minister of Finance announced the province’s 2024 budget. This article highlights the most important things you need to know about this budget, broken into 2 sections:

-

Personal Tax Changes

-

Business Tax Changes

Personal tax changes

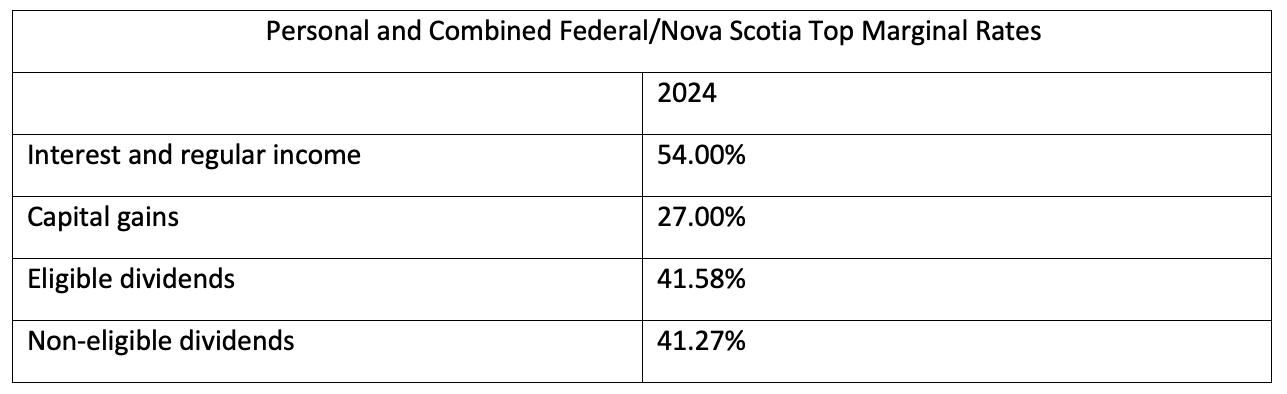

There are no changes to the province’s personal tax rates in Budget 2024.

As a result, Nova Scotia’s personal income tax rate remains as follows:

Indexation of personal income tax system:

The budget proposes the implementation of indexing within Nova Scotia’s provincial personal income tax system, aligning it with the province’s inflation rate starting from the 2025 tax year and onwards. It specifies that taxable income brackets will undergo annual adjustments, and the subsequent non-refundable tax credits will also be indexed, including:

-

Basic personal amount

-

Spouse or common-law partner amount

-

Amount for an eligible dependant

-

Age amount

-

Amount for infirm dependants aged 18 or older.

These adjustments to tax brackets and non-refundable tax credits will come into effect on January 1, 2025.

Business tax changes

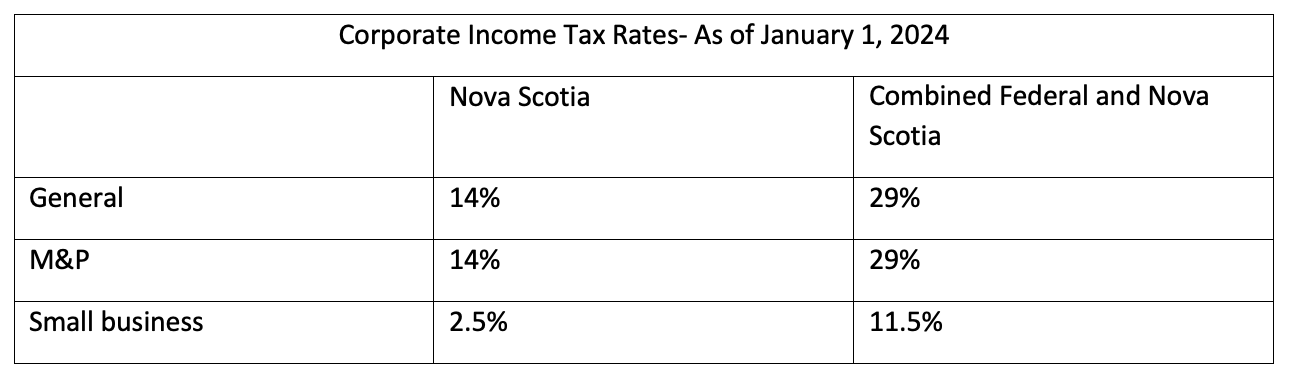

There are no changes to the province’s personal or corporate tax rates in Budget 2024.

As a result, Nova Scotia’s Corporate income tax rate remains as follows:

We can help!

Wondering how this year’s budget will impact your finances or your business? We can help – give us a call today!

Source: https://novascotia.ca/budget/